Using Dais as a Headless Platform for Premium Finance Capabilities

Dais is a Software as a Service (SaaS) platform providing innovative solutions for carriers and MGA's to build, maintain, and enhance their insurance products. This all-in-one no-code platform allows your team to create products quickly and efficiently, with robust integrations seamlessly connecting with other systems in your ecosystem.

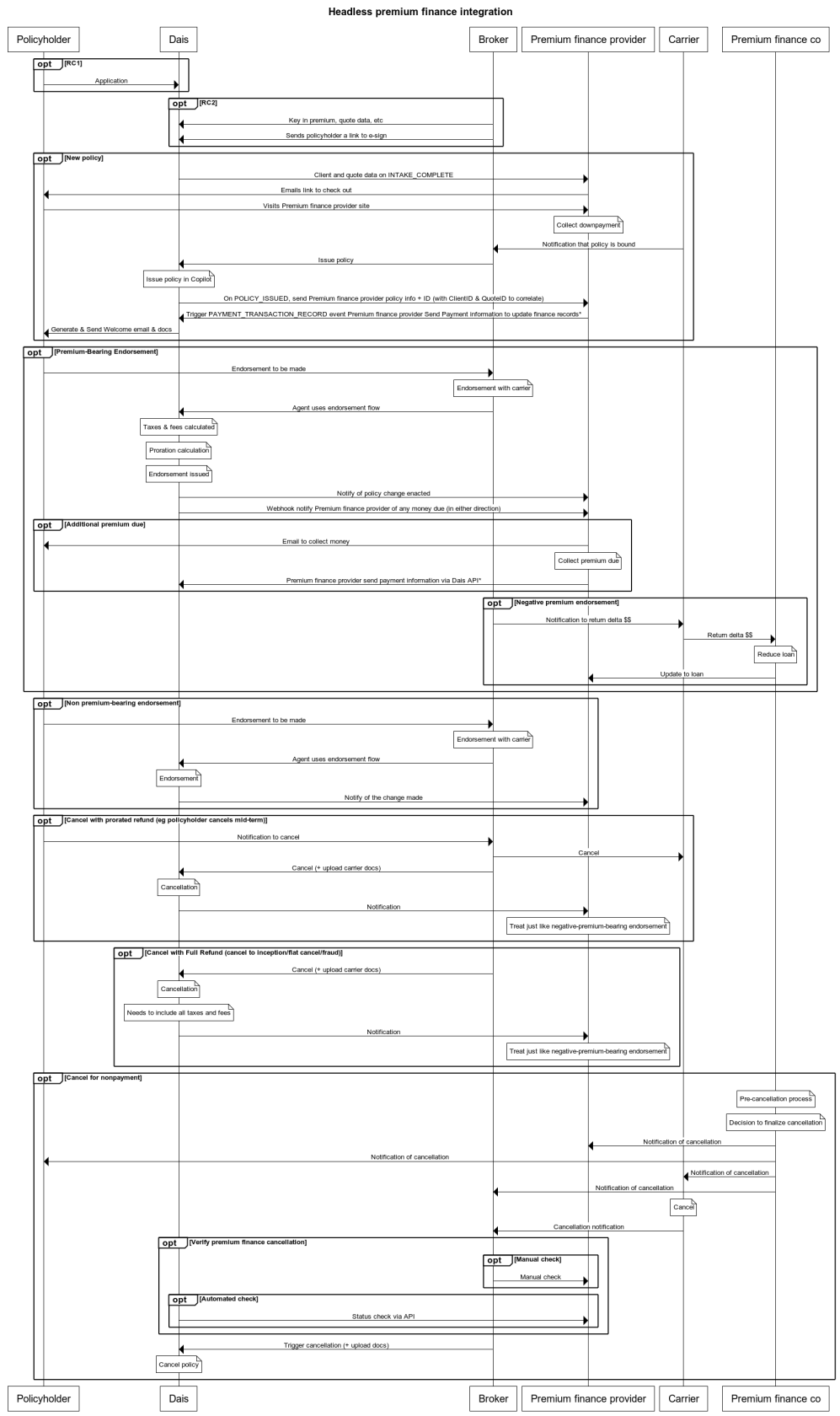

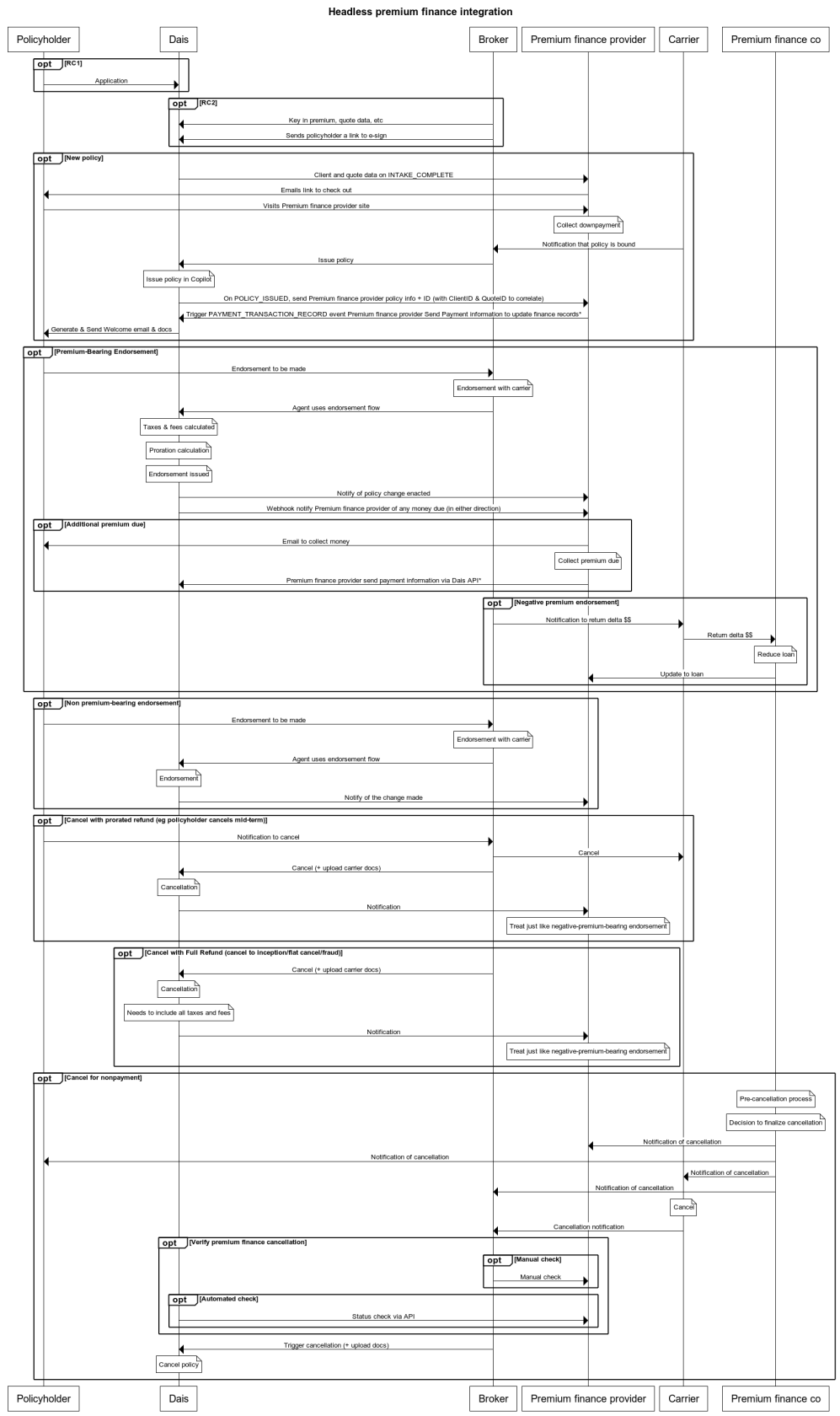

In this article, we will discuss using Dais as a headless platform to support premium finance capabilities for brokers. A sequence diagram is provided to illustrate this complex process, breaking down each step for easy understanding.

Sequence Diagram Overview

The sequence diagram titled "Headless premium finance integration" maps each step in the process of how Dais interacts with a policyholder, broker, carrier, and premium finance provider to handle a range of scenarios like new policy issuance, policy changes, and cancellations.

Key Players:

- Policyholder: The insured individual or company.

- Dais: The SaaS platform used to manage insurance products.

- Premium finance provider: The financing company that enables the policyholder to pay their insurance premium in installments.

- Broker: Intermediary who serves the interests of the policyholder and acts on their behalf.

- Carrier: The insurance company, responsible for underwriting insurance risks.

Exploring the Diagram:

New Policy Creation:

In this scenario, the policyholder applies for a policy through Dais. The broker then keys in the premium and quote data, provides the policyholder with a link to e-sign, and subsequently, issues the policy. Throughout these steps, Dais communicates with the premium finance provider, sending client and quote data, and finally, issuing the policy. The premium finance provider collects the downpayment, and then upon policy issuance, communicates with Dais regarding the payment transaction record.

Premium-Bearing Endorsements:

If the policyholder requires a change that will impact the policy’s premium, they can request an endorsement through the broker. The broker will make the necessary changes, with Dais handling the calculations for taxes, fees, and prorations. Any premium changes are communicated to the premium finance provider who will then notify the policyholder of any additional charges or refunds.

Non-premium-bearing Endorsements:

Here, the policyholder needs a change to the policy that does not impact the premium. The process is quite similar to a premium-bearing endorsement, without any financial adjustments.

Policy Cancellation:

The policyholder may decide to cancel the policy. Depending on whether it's a prorated refund, full refund, or for non-payment, Dais interacts with the broker and premium finance provider differently. For cancellations with refunds, Dais notifies the premium finance provider, who in turn processes the refund as applicable.

Throughout these processes, Dais handles complex calculations, interactions between parties, and policy modifications, showcasing its potential as a powerful, facilitating platform for premium finance capabilities.

Understanding these various iterations of policy lifecycle processes can help leverage Dais' capabilities effectively, ensuring a streamlined insurance product lifecycle management.